Need some quick answers on setting up Autopay? You found an excellent place to start.

A Quick Quote will estimate Woodside Credit’s low monthly payment based on the purchase price of the vehicle. Credit is not reviewed, and no credit check is required (approval is not guaranteed). Apply Now will start a credit application with our underwriting department, and upon approval locks in your low monthly payment for up to 30 days.

With a commonsense approach to underwriting, Woodside looks at client’s full financial picture to provide competitive down payments and low monthly payments. Woodside Credit looks for established credit history, comparable credit, and on-time payments. Good and top-tier credit (700+) is preferred for approval. Feel free to reach out to us to determine if you will qualify, and our loan experts can assist you.

Our list of eligible cars is always growing, so give us a call for unique vehicles to finance. Eligible vehicles include classic cars at least 25 years old and most late model exotics cars from the likes of Ferrari, Lamborghini, Maserati, Bentley, Rolls-Royce,

and Aston Martin. We also Finance some specialty and collector vehicles such as Cobra Replicas, Dodge Vipers, Chevrolet

Corvettes, and Porsche 911s.

A combination of the lowest payments in America and flexibility to pay off the loan on your schedule (without prepayment penalties) means interest costs can be less than you expect. Loans are simple interest and provide the best of both worlds–competitive rates with the flexibility to use your cash for other financial goals.

Yes. Woodside Credit will refinance an existing car loan or a cash purchase that has been made within the last 6 months.

Sometimes inspections, vehicle verifications, or appraisals are required for our underwriting purposes, most commonly for private party automobile purchases. Woodside Credit takes a high-tech approach for quick processing, including virtual inspections via a phone app. Your dedicated loan officer will guide you through specific needs based on where the purchase takes place and the value of the vehicle.

Yes. Woodside Credit does offer lease buyouts, especially common for those with exotic vehicles. Call or contact us to lean more from our lending professionals.

No. Woodside Credit is a nationwide auto lender with relationships with thousands of dealerships, Barrett-Jackson Auctions, and private parties. Ask your dealer if Woodside is an option when financing your next exotic or collector car. Pre-approvals can be obtained for all future purchases, regardless of where you buy.

Yes. Insurance is required on the vehicle for its full replacement value. Borrowers will need to provide an insurance binder with Woodside listed as loss payee before funding the loan. Woodside Credit partners with Hagerty, the largest provider of specialty insurance for collectible vehicles, for those looking for competitive insurance rates.

Yes. Borrowers are required to register and title the car once it is purchased. Title and registration fees are typically built into the loan. The title department at Woodside Credit coordinates with all state DMVs to complete title work—even if the vehicle is purchased out of state.

Instructions for sending payments is provided when the loan is closed.

Yes. Borrowers will receive auto payment instructions after the first payment.

Yes. Additional payments can be made on your simple interest loan. Anything over the minimum payment is applied directly to the principle.

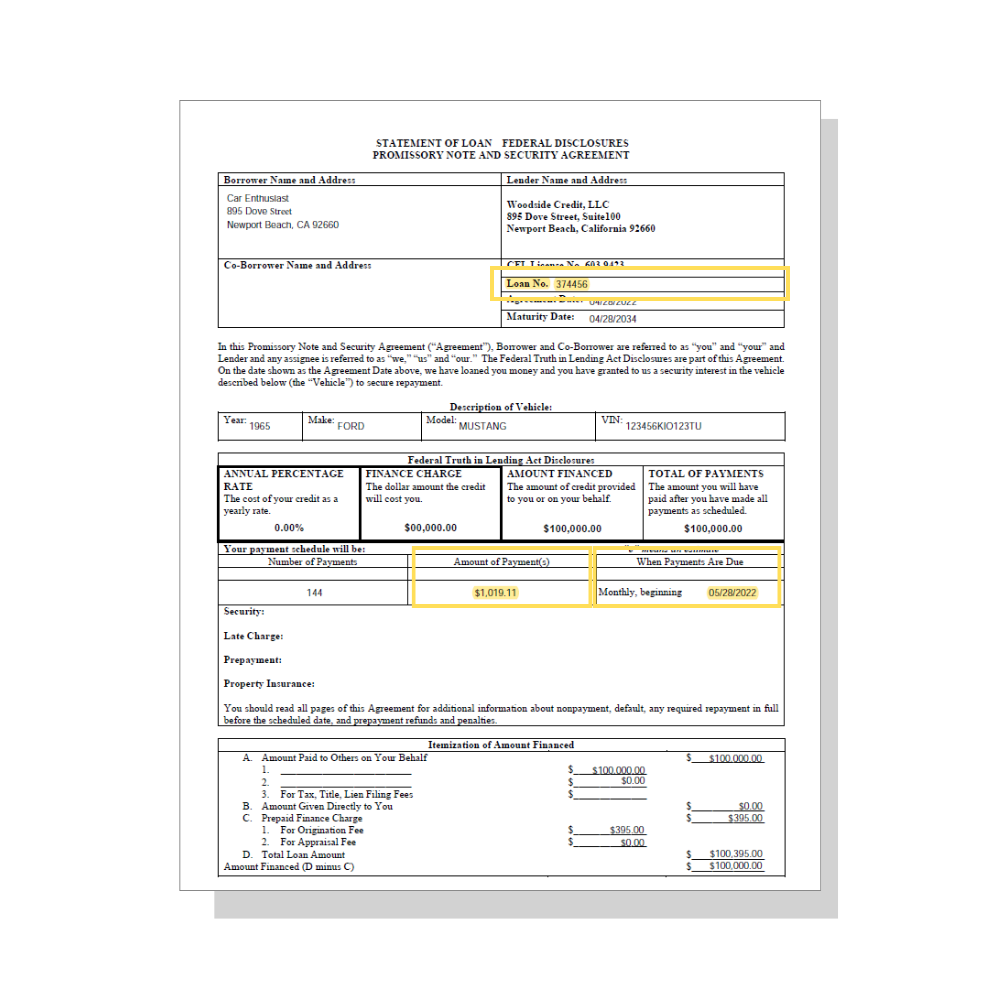

Your Loan Number, Amount, and Due Date can all be found in your loan documents. You have been sent a copy of your completed loan documents via email. See highlighted example for where to find these items within your documents:

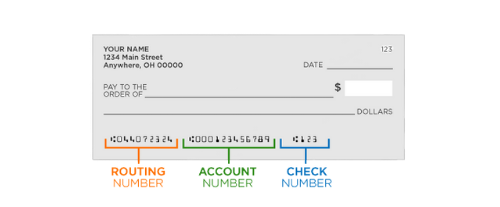

You’ll be asked to provide your banking information for autopay. Your routing number and checking number can be found on a check, or within most online banking platforms.

Bidding with Woodside Credit starts with a pre-approval, which can be obtained over the phone, on our online application, or at the auction. You will select the amount you would like to be pre-approved to and Woodside will send a copy of your pre-approval directly to Barrett-Jackson. The final vehicle purchase should fall within the pre-approval amount.

Your letter of credit approval will be sent directly to Barrett-Jackson. The copy you receive is for your personal records.

No, absentee and online bidding is available, and you can bid with your pre-approval from Woodside Credit.

Woodside Credit is located near or at the Bidder’s office at all Barrett-Jackson auctions. Bidders can complete paperwork at the Woodside booth, or online through eSign.

Yes, a pre-approval is required every time in addition to bidder registration with Barrett-Jackson.

No, automatic monthly payments are complimentary. This is offered as a convenience, so you have confidence in knowing these will be paid on time and accurately posted each month.

Once enrolled, your payment will be automatically deducted from your checking or savings account every month and applied to your loan.

You may cancel your automatic monthly payments at any time by written notice, a minimum of 10 business days before your loan’s next payment due date.

Woodside’s form does not allow for a date other than your specified monthly due date. If you need to change the due date on your loan documents, please reach out to your loan consultant or support team to re-draw.

Woodside’s form does not allow for payments other than the specified monthly payment. After the first payment has been made, you can reach out about adding funds towards principal every month.

We require that the name on the account match (at least one) borrower’s name. You can not set up this automatic payment to come from your business account, a friend or partner’s account, or anyone not listed as a borrower on the loan.

Yes. Woodside will still send your first account statement to the email used for your documents, within a week of funding. That statement will be part of an email that explains the next steps for your loan and how the billing process will work.

We require that the autopay form be filled out prior to funding of the loan.

*Monthly payment of $555.05 based on a purchase price of $50,000.00 with 15% down and 9.72% APR financing for 120 months. Monthly payment of $937.71 based on a purchase price of $100,000.00 with 20% down and 9.60% APR financing for 144 months. Monthly payment of $1,674.88 based on a purchase price of $200,000.00 with 20% down and 9.54% APR financing for 180 months. TT&L may also be financed. Not all applicants will qualify. Rates and terms are subject to change. All trademarks, logos and brand names are the property of their respective owners.